For my current work I have to be aware of and understand a lot of the goings-on in the heat treating world. One avenue for pursuing this are trade journals. Like virtually every field there is a trade journal for it, and the one I am going to be talking about in Industrial Heating.

Reed Miller (pictured) puts out a rant pretty much every month about how bad the Obama administration is (or how bad it was going to be). Its pretty funny, as the economy is falling apart all around him, he was decrying how bad the next administration was going to be.

Anyway, this month was their energy savings edition. In it we get treated to not one but two rants by Miller, the editor and also Barry Ashby the Washington editor. First lets look at Millers contribution.

He starts out with the same canard you hear from every denialist: Implementing actions designed to curb climate change will ruin the economy.

As our nation became engaged in a protracted recession, no one believed “climate taxes” would happen here because it would be pure foolishness. Nobody is foolish enough to tax the engine of our economy in the midst of a recession, right?

When our president was elected, how-ever, it became clear that he wasn’t going to let a little thing like a recession prevent him from going down that road. Since President Obama seems to take his cues from Europe, I began to watch what was happening there to get a sense of where we would likely go in the U.S. In January, we began to document the news reported by our friends in Europe as well as what was happening right here in a bulletin-board thread on our website.

Let’s look at an important part there. He says that he has been looking at what is going on with other countries that have in fact implemented cap and trade schemes.

It’s hard to even mention this topic without discussing the basic reason for a carbon tax. The overhyped global-warming issue is the reason/excuse that is used. Because there has been no documented warming in the past 11 years, however, global warming is now referred to as climate change, but by any name the remedy is apparently the same – taxing consumers.

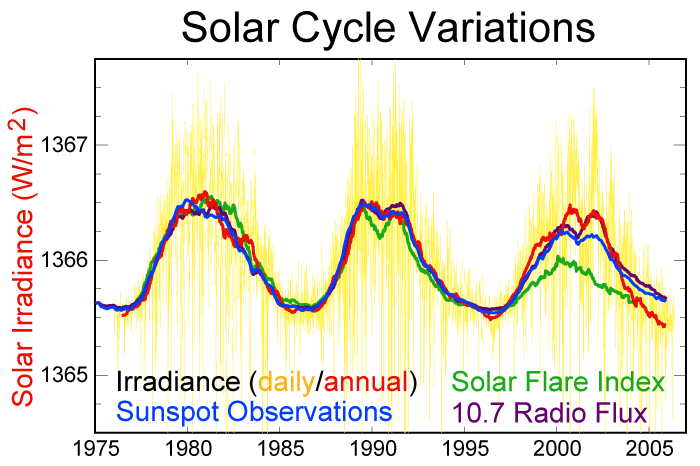

Sigh. I sigh every time I read that sort of nonsense. There is plenty of warming that has occurred, it is masked by the extremely high maximum that occurred in 1998 and the recent solar minimum. You only think that global warming has stopped if you choose a small data set and try to fit a straight line to it. You have to completely ignore the physics. You have to ignore the fact that temperature has not dropped off when solar irradiance has.

The sun only recently has reversed course to start shining more and more light on the Earth. We can expect this “global Warming has stopped” trend to be at an end now. So once you have put yourself into the global warming denial camp, is there any reason to expect endorsement of policies that go towards countering these issues? I think not.

Obama’s goal from the beginning has been to enact a European-style cap-and-trade system as a tax. If you don’t think this type of system is taxation, here’s what Obama had to say: “Under my cap-and-trade plan, electricity prices would necessarily skyrocket.” Testifying before Congress, Obama’s budget director said, “Firms would not ultimately bear most of the costs of the (cap-and-trade) allowances but instead would pass them along to their customers in the form of higher prices … price increases would be essential to the success of a cap-and-trade program.”

uh oh… an ellipsis. Now I have to go look this up. Well first off, I find out that the first quote was not in regard to the current energy plan. Obama said this over a year and a half ago with respect to a different plan altogether. The second quote is not related to the first.

Now I am not going to pretend that I understand the intricacies of a Cap and Trade program and its effects on the economy. Seems to me, since industry is unwilling to cut carbon emissions voluntarily, some form of regulation needs to be put in place. Cap and trade is not only being used in Europe (remember Mr. Miller said he has been watching the results over there), but we use cap and trade for emissions already!

What? You didn’t know that? Yeah, we implemented a successful cap and trade program for sulfur dioxide, the main cause of acid rain. Since then acid rain and its effects have improved.

As it became obvious Congress was not going to enact cap and trade quickly enough for Mr. Obama, he decided to force their hand through the regulatory process. On April 17, the EPA declared that CO2 and five other greenhouse gases “endanger public health and welfare.” Obama is clearly trying to skirt the legislative process by not allowing the necessary discussion to take place. About cap and trade, lawmakers have stated, “Legislation so far-reaching should be fully vetted and given appropriate time for debate.” Unfortunately, if legislators take the proper amount of time, Obama seems ready to use the EPA ruling under the Clean Air Act to short-circuit the process and accomplish the same objective.

I’m sorry, where have you been for the last 30 year that this has been discussed? Obama is not short circuiting the process. The bill still has to go through congress. No congress, no debate. 30 years is plenty of time. Never mind the fact that this quote is also out of context. It was by Mike Johanns, a nebraska republican, who was not complaining that the Cap and Trade system was being skirted by congress, he was taking issue with the method by which it was being introduced in congress (through a budget reconciliation process rather than a stand alone bill). I agree it shoudl be a stand alone bill, but Mr. Reed, by taking his quote out of context had implied that Obama was trying to skirt Congress altogether, which is simply not true.

Cap-and-trade legislation is intended to apply to power plants, steel mills or other large emitters of CO2. If taxation occurs through regulation with the EPA invoking the Clean Air Act, however, smaller businesses could also be affected.

And out comes the slippery slope argument.

Under this type of heavy-handed rule making, I wonder what will happen when all of the Wal-Mart haters of the world get their hands on this?

And the fear mongering.

Assuming cap-and-trade legislation is the likely result, what will it cost the consumer? An MIT study looked at the scheme proposed by the president, who projects revenue of $366 billion in a single year. Quoting the study, John Ensign, a U.S. Senator from Nevada, estimated the tax burden on each family would be $3,000 per year. Using an alternative household number given in the MIT study, the annual impact could be as high as $4,560 per year. It is promised that some of the taxed money will be rebated back to consumers, but some of it will also be used for other purposes. Most of us know how effective government rebates are. Once they get the money, they are unable to let it go. So, it’s anyone’s guess as to what our net tax liability will be. Needless to say, it will be painful.

Any chance that this is the study that you are misusing? Republicans in congress were specifically corrected by the author who specified the additional cost may be 340 dollars. Mr. Miller is over stating this cost by ten times. Then we are supposed to trust him that the $3000/year is definitely right, but the rest of the program will never come through. Mr. Reed is cherry picking.

Can we afford another tax? Will manufacturers remain in the U.S., or will they find a less-taxed place in which to do business?

More fear mongering.

But wait! I thought he said he has been examining the effects of cap and trade in Europe. Well? What happened with that riveting analysis?

I’m am not making any claims that Cap and Trade is the right thing to do, I’d support a straight out tax on carbon that many republicans are calling for. The fact is that it is high time to get some action going and I am glad to see our president finally breaking the shackles of mediocrity and getting something in motion. Articles like Mr. Reeds provide absolutely nothing but a one sided masturbatory exercise in denialism.