Well since this is something I worked on recently I'll post it here. I went to a financial planner recently to try to see if they had some good advice. As I understand it, there are two types of people financial planners dislike working with Teachers and engineers. Im not sure about why teachers are one of them, but I know why engineers are the other. Im guessing Doctors dont really like us for the same reason. We question EVERYTHING they suggest looking for the reason why they make one decision or another.

Well I think we are justified in this. When I went there, they said I had enough money for them to give me this great service where they constantly monitor my portfolio, and guide the progress. I gave them a goal of providing 10% growth per year. I told them I didnt expect every year to be 10% but that at the end of 20 years I want to look back and find that my average growth was 10%. This is not an overly aggressive goal.

So he suggested 10 different mutual funds. None of the 10 were the same as what I'm currently invested in. So there would be fees and so forth upon buying all these. So I asked about why these ten and why not the 7 or so i already had. He gave me reasons about small cap and large cap amd balancing it all out and so forth. Of course I pressed on it. Isnt it the job of the fund itself to provide the growth? Why would I pay 1.5% extra to have this planner provide another layer of management on it? He said to take a look at the growth of his suggestions and that I would see the value he is providing. So I did.

The funds I had are pretty much a random smattering of funds. No real thought put into them. Someone suggested them, they had good morningstar ratings, so thats what I have. I am also invested in a few stocks (mostly alternative energy stocks, Texas Instruments, and Orchid Paper Products).

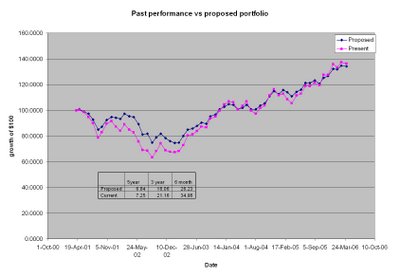

Well, I compared the growth of my present portfolio for the last 5, 3, and 0.5 years and the growth of the proposed porfolio.

Well this wasnt really a suprise to me (sorry about the 4 decimal places on the Y axis, thats dumb)..

The two portfolios performed essentially the same, mine is a little more volatile. Both had high rated funds in them. I realize this picture is small. It shows the growth of 100 dollars over the last 5 years with the two portfolios. The little box says that 5 year returns averaged to about 7%, 3 year returns came to about 19.5% and 6 month returns came to about 30% (these are annualized returns). While my current portfolios performed better in each case, I dont think I would say its a significant amount.

While this is certainly not a statment about the financial planning business in general, nor is it right to say none of the planners are particularly more acute than others, they just are not for me.

They are probably best for people who dont really want to get into the nitty gritty, but just want someone to trust to do it for them. Like having someone do your taxes. Im not saying I am qualified to be a financial planner, just that I suspect that they are not needed, you would be better served by doing a marginal amount of research and buying things on your own. Even as little as I did for these funds, I simply took high rated funds.

freaky financial planner

Posted Thursday, April 20, 2006 by Techskepticfreaky financial planner

2006-04-20T15:31:00-07:00

Techskeptic